Low Code Future: No. 15

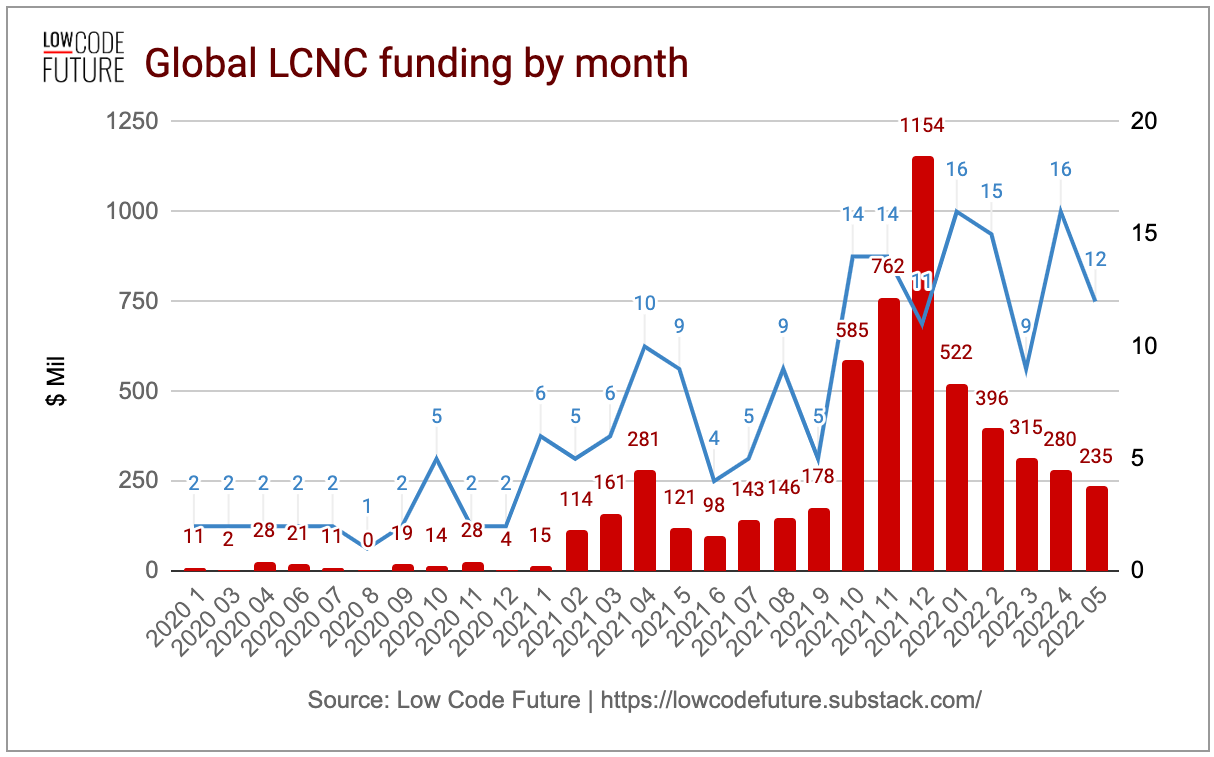

What happened in May 2022? Over $230 Million invested in LowCode/NoCode, across 12 companies.

Winter is here! Actually, not there yet.. Yes, May was the fifth month in a row with declining capital invested, on the other hand we are back to the more “normal” levels of Q2/Q3 2021. The number of deals is stable, simply there were less late-stage deals.

DEALS 💸

Do you want to see all (400+) investors? You can now browse our Airtable: https://airtable.com/shrfSFmtN5aYYCfk9

[Evisort, USA, $100M led by TCV] Evisort provides a business solution for contract management and analysis. The cloud-native contract intelligence platform helps businesses operate efficiently, and identifies and surfaces relevant insights to help contract professionals and stakeholders deliver results. Read here.

[Zip, USA, $43M led by YC Continuity] Zip provides an enterprise-grade platform that enables employees to make business purchases with a consumer-style experience. The platform provides pre-built and configurable no-code workflows for any non-technical employee. Read here.

[Accern, USA, $20M led by Mighty Capital and Fusion Fund] Accern provides a NoCode NLP Platform that empowers domain experts and business analysts to extract the insights from massive streams of unstructured data—news, social media, industry reports and internal documents—within minutes. Read here.

[Predibase, USA, $16.25M led by Greylock] Predibase is designed to enable developers to define AI pipelines in just a few lines of code while scaling up to petabytes of data across thousands of machines. Read here.

[CoverGo, Hong Kong, $15M led by SemperVirens VC] CoverGo has developed an insurance industry’s modular, no-code insurance platform powered by over 500 open insurance APIs enabling insurance companies to go digital in a flexible and scalable way. Read here.

[Kinetix, France, $11M led by Top Harvest Capital] Kinetix has built a no-code platform that allows Web3 and content creators to transform any video into 3D animated avatars. Read here.

[Highlight, USA, $11M led by Haun Ventures] Highlight, a no-code toolkit that lets anyone create a Web 3 community with non-fungible tokens (NFT). Read here.

[Tignis, USA, $7.2M led by DN Capital] Tignis’ PAICe Product Suite accelerates the ability to build, validate and deploy physics-driven, machine learning-enabled solutions in semiconductor manufacturing. PAICe Monitor allows process engineers to quickly harness data using the proprietary low-code language to find and investigate problems with production, while PAICe Maker speeds up simulations, enabling semiconductor manufacturers to adaptively control complex OEM machinery in real time. Read here.

[Cogniteam, Israel, $5.6M led by Seabarn Management] Cogniteam provides Nimbus, a robotics AI operating platform, which boosts collaborative robotic development capabilities, helping companies bring new robotic programs to market in a fraction of the time. Read here.

[Basetwo, Canada, $3.8M led by Glasswing Ventures and Argon Ventures] Basetwo is a no-code AI platform that enables process engineers to build and operationalize digital twins of their manufacturing plants. From process development to commercial manufacturing, manufacturers use the digital twins they build with Basetwo AI to improve process efficiencies across the value chain. Read here.

[TeamCentral, USA, $1.5M led by CincyTech] TeamCentral provides a low-code software platform that enables connections between applications to be made more quickly by IT professionals, often with less experience. Users are guided by virtual assistants to complete integrations, enabling some tasks to be completed by employees without formal IT training. Read here.

[Cooee, UK, $0.3M led by Jenson Funding Partners] Cooee provides a SaaS-based, low-code platform that delivers one-to-one personalised in-app and push notifications that help businesses increase revenue and reduce churn. It uses AR, computer vision and machine learning to create unique engagements for every customer in real-time. Read here.

WHAT WE’VE BEEN READING 📚

[AIM] Is India shifting to low-code/no-code platforms?

LC/NC Industry is expected to grow at a CAGR of 28.1% from 2021 to 2025

Low-code application development will account for over 65% of application development activity by 2024

Tata Consultancy Services won 24 LC/NC contracts in the third quarter of the current fiscal year. Infosys is also hiring talents to deliver on LC/NC solutions.

[VentureBeat] AI and low/no code: What they can and can’t do together

AI is gravitating increasingly toward mobile and web applications, where even delays of 100 ms can drive users away

For back-office apps that tend to quietly churn away for hours this shouldn’t be much of an issue, but then, this isn’t likely to be a ripe area for LCNC either.

It’s probably an overstatement to say that AI and no/low-code are like chocolate and peanut butter :) but there are solid reasons to expect that they can enhance each other’s strengths and diminish their weaknesses in a number of key applications